This is a hellobar to show announcements

This is a hellobar to show announcements

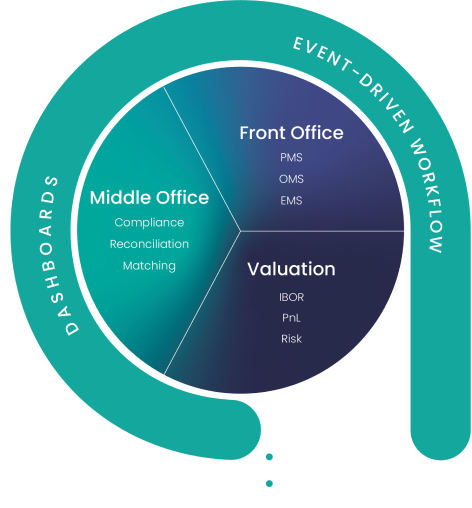

Our cloud-native technology delivers class-leading portfolio management through an open architecture. The MAIA platform is functionally rich and combines high levels of STP with resilience in high volume scenarios. Multi-asset, single-asset and evolving businesses can select from pre-configured or fully customised workflows. MAIA is future-ready with the flexibility to adapt and scale with your business.

MAIA is delivered out of the box to provide accurate PnL and shadow NAV as well as trading, compliance, and risk. Built from a blank canvas, MAIA is designed to handle the challenges and complexity of running multi-strategy portfolios with speed and efficiency.

MAIA delivers a pre-configured solution for long only, long/short, multi-asset or global macro strategies using best-in-class workflows, and scales to support both start-up and established funds.

Find out moreMAIA supports an unlimited number of users, workflows and integration points across data, trading, compliance, and operations.

Find out moreDelivered under a cloud-native SaaS framework, the MAIA platform is tailored to precisely fit your operating model.

Find out moreIntegrated with your own technology, Systematic powers trading and middle office workflows. A client gateway supports seamless integration with upstream systems.

Find out moreMAIA’s platform handles all your workflows from pre-trade to post-trade and readily integrates with other applications and services within your ecosystem. Accelerate STP quickly and efficiently without constraint.

Our technology is an API first, open architecture. Being cloud-native and with no technical debt, our workflows flex around your existing operating model.

Grow and scale with confidence knowing you'll never need to change platform again.

You can import new workflows from a library of capabilities, without requiring an upgrade or reconfiguration of the system – MAIA is light-touch.

We have pre-existing integrations with an array of third parties so you will benefit from a streamlined onboarding process.